Markets eye PMIs and US debt-ceiling negotiations

Following Monday’s choppy action, financial markets stay relatively quiet early Tuesday as investors await S&P Global PMI surveys for the Eurozone, the UK and the US. Market participants will continue to keep a close eye on headlines surrounding the debt-limit talks and comments from central bank officials.

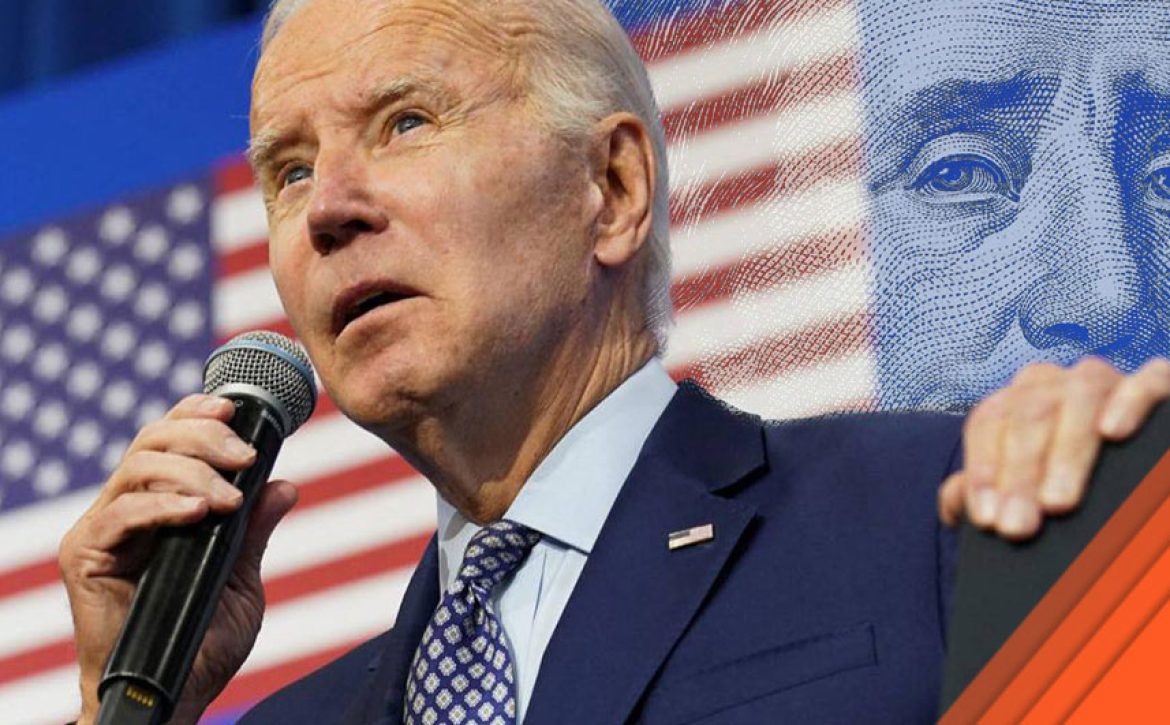

US President Joe Biden and House Speaker Kevin McCarthy failed to reach an agreement on raising the government’s $31.4 trillion debt ceiling ahead of the estimated June 1 deadline. In a statement released following the meeting, “we reiterated once again that default is off the table and the only way to move forward is in good faith toward a bipartisan agreement,” Biden said. The sides are expected to continue talks over the phone throughout this week.

US stock index futures trade virtually unchanged on the day and the benchmark 10-year US Treasury bond yield holds steady above 3.7%. In the meantime, the US Dollar Index (DXY) fluctuates in a tight channel slightly below 130.50. In addition to S&P Global PMIs, the US economic docket will also feature April New Home Sales and Richmond Fed Manufacturing Index for May.

EUR/USD struggles to stage a recovery and continues to trade at around 1.0800 early Tuesday. The data from Germany showed in the European morning that the HCOB Manufacturing PMI dropped to 42.9 in May from 44.5 in April, revealing that the business activity in the manufacturing sector continued to contract at an accelerating pace.

GBP/USD stays under modest bearish pressure and edges lower toward 1.2400. Bank of England Governor (BoE) Andrew Bailey and other policymakers will be testifying before the UK Treasury Select Committee from 0915 GMT.

USD/JPY climbed toward 139.00 and touched its highest level since November during the Asian trading hours on Tuesday before staging a downward correction. As of writing, USD/JPY was trading flat on the day near 138.50. Earlier in the day, the data from Japan revealed that Jibun Bank Manufacturing PMI and Jibun Bank Services PMI improved to 50.8 and 56.3 in May, respectively.

Gold price turned south amid rising US Treasury bond yields and closed the day in negative territory. XAU/USD continues to stretch lower early Tuesday and was last seen losing nearly 1% on a daily basis below $1,960.

Following Monday’s indecisive action, Bitcoin gained traction early Tuesday and climbed toward $27,300. Ethereum broke out of its two-week old horizontal channel and was last seen rising 2% on the day at $1,850.