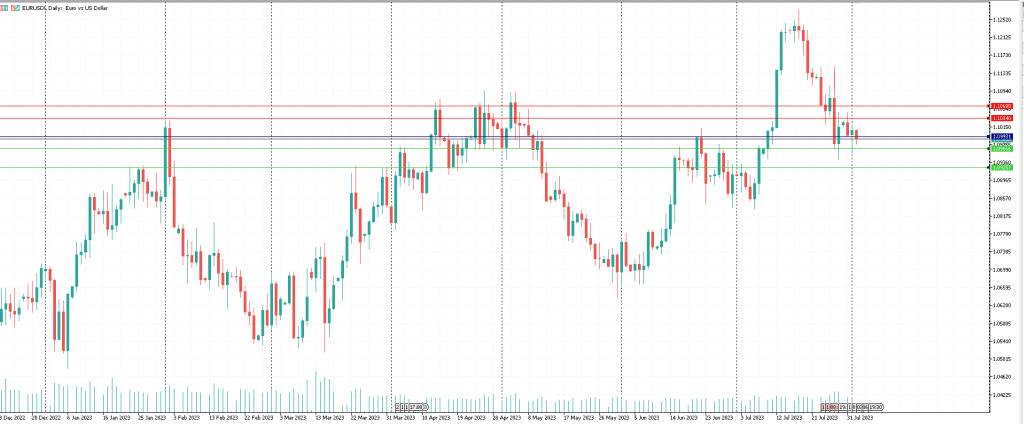

Technical Analysis (21 AUG)

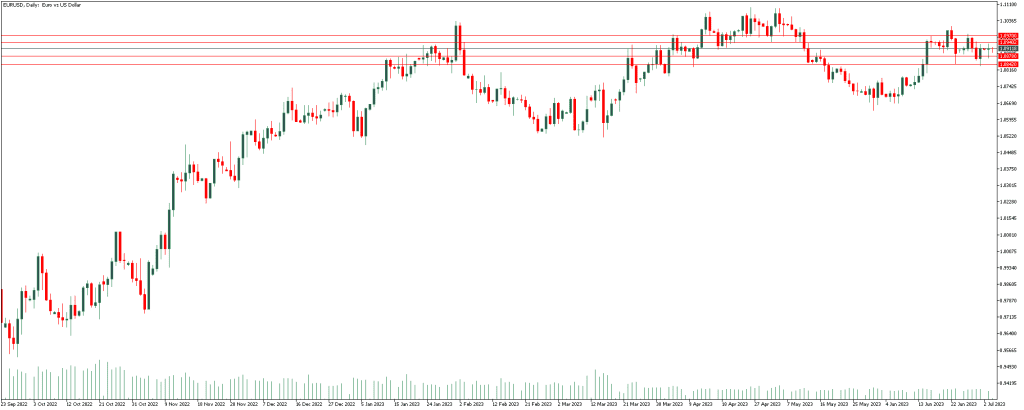

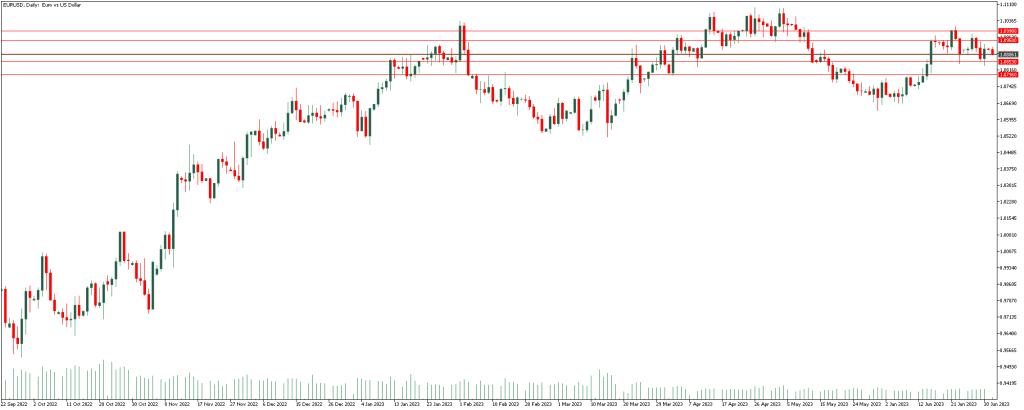

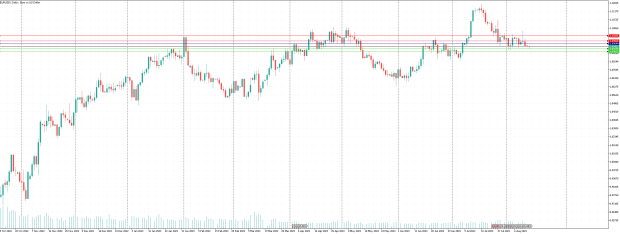

Euro – US Dollar

EUR/USD is posting small gains in Monday’s European morning, having stalled its recovery under 1.0900. The upside seems capped in the wake of renewed safe-haven demand for the US Dollar. Traders now look forward to the Buba monthly report for a fresh impetus.

If trading above 1.08692 is traded, the growth will likely continue to 1.09181.

On the other hand, if it trades below the range of 1.08692, the decline is likely to continue to 1.08202.

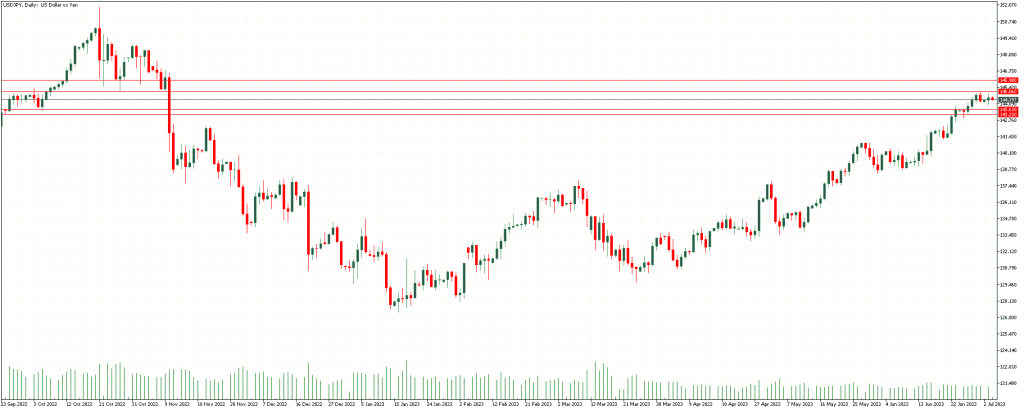

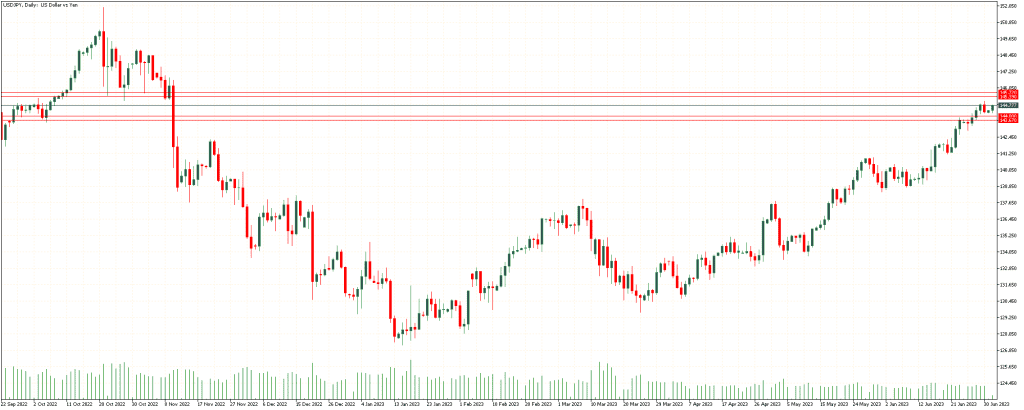

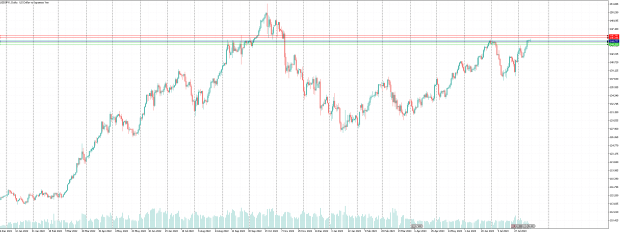

US Dollar – Japanese Yen

The USD/JPY pair oscillates in a narrow range below the mid-145.00s heading into the early Asian session on Monday. Traders prefer to wait on the sidelines amid the risk-averse mood and await the Federal Reserve (Fed) Chairman Jerome Powell Speaks at the Jackson Hole Symposium on Friday.

If the pair continues to trade above the range of 145.379 It is likely to continue climbing to 146.212.

On the other hand, if the pair is traded below 145.379, it is expected to continue falling to 144.963.

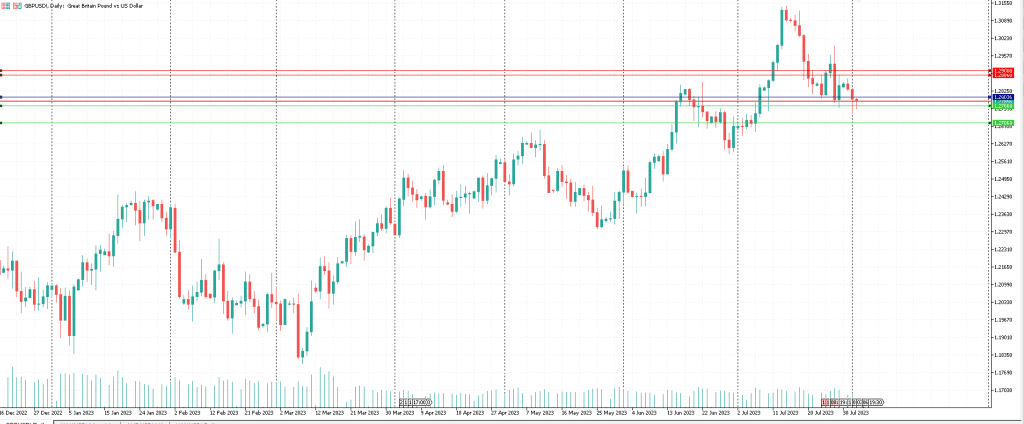

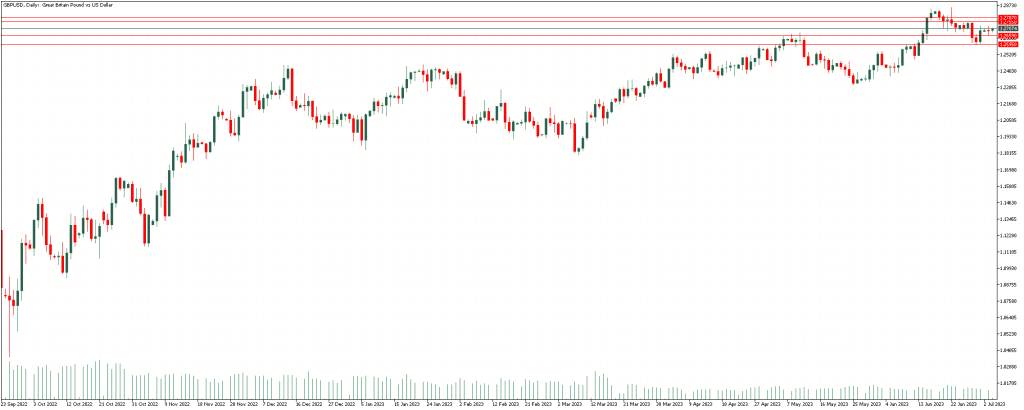

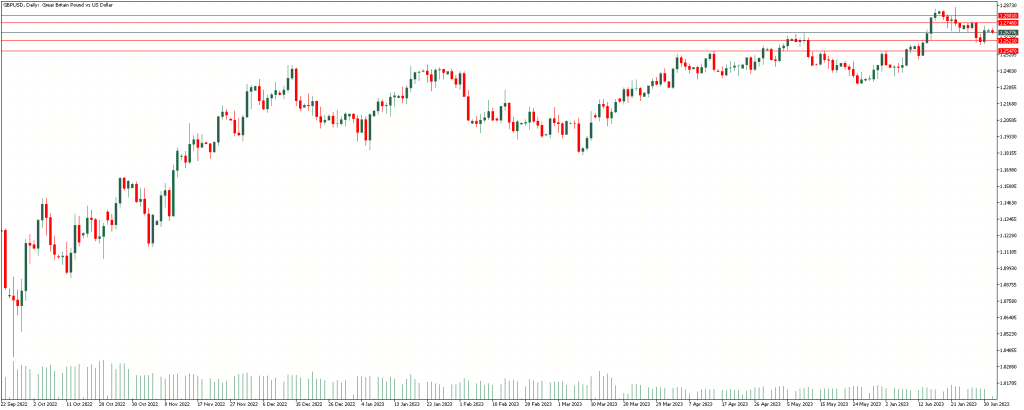

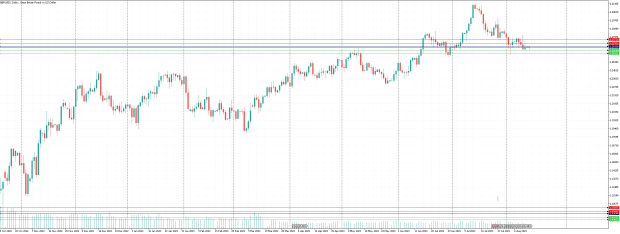

British Pound – US Dollar

GBP/USD attracts some buyers on the first day of a new week, sticking to its modest gains, below mid-1.2700s. The pair remains confined in familiar trading, as the mixed fundamental backdrop warrants caution ahead of the Fed’s Jackson Hole Symposium due later this week

If the pair is trading above 1.27290 it is expected to climb to the range of 1.28059.

On the other hand, if the pair trades below 1.27290 it is expected to fall to the range of 1.26920

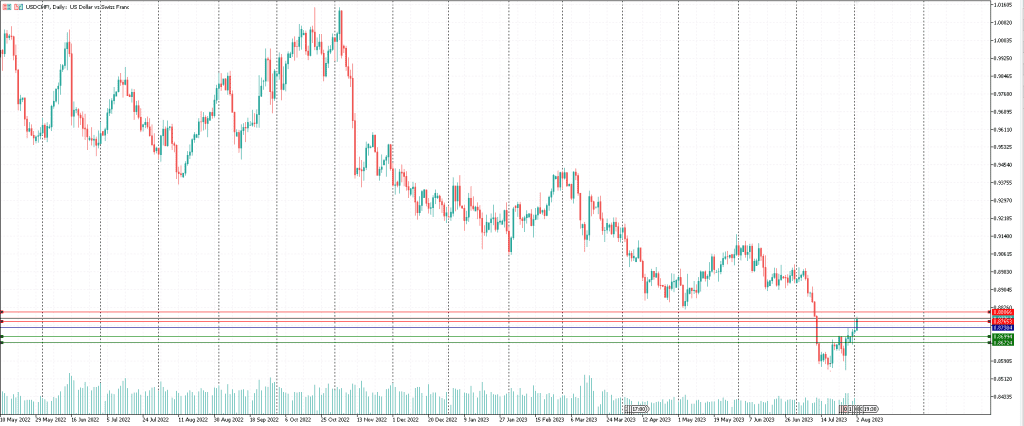

US Dollar – Swiss Franc

USD/CHF lacks clear momentum around 0.8820, after refreshing a six-week high to 0.8828 heading into Monday’s European session. In doing so, the Swiss Franc (CHF) pair portrays the market’s indecision ahead of the top-tier data/events.

If the pair is trading above 0.88077 it is expected to climb to the range of 0.88420.

On the other hand, if the pair trades below 0.88077 it is expected to fall to the range of 0.87880.

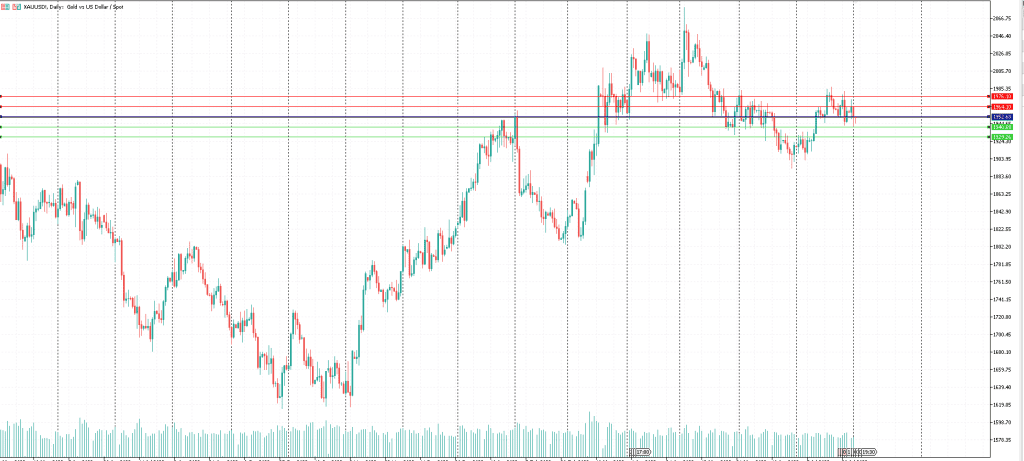

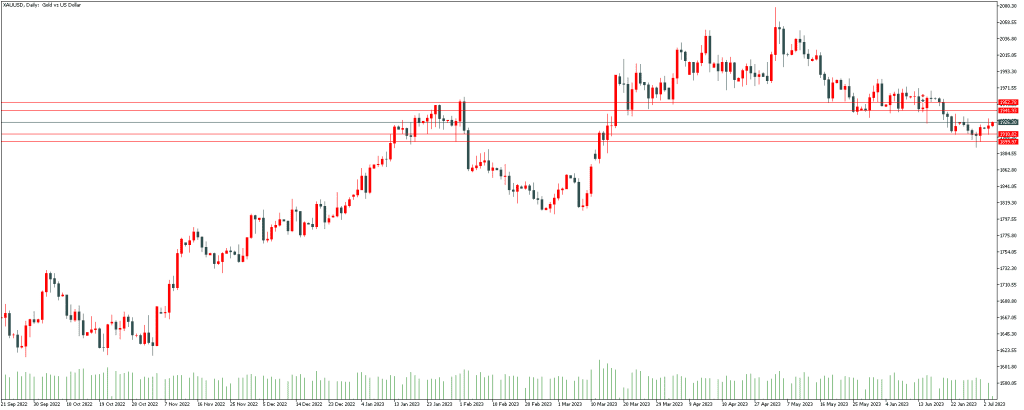

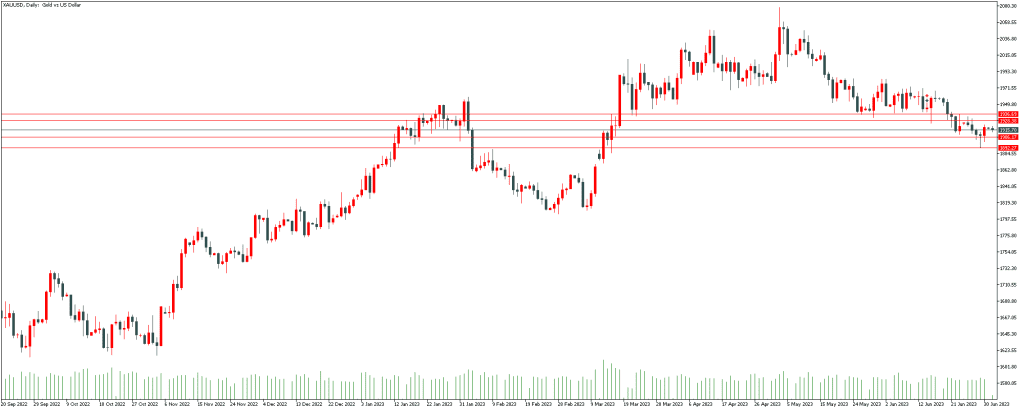

Gold – US Dollar

Gold Price remains on the back foot at the lowest level in five months as market players seek solace in the US Dollar amid uncertainty ahead of this week’s top-tier data/events. Also exerting downside pressure on the XAU/USD could be the pessimism surrounding one of the world’s most significant commodity users, namely China.

If the pair is trading above 1890.92 It is expected to climb to the 1895.10 range.

on the other hand, if the pair trades below 1890.92 It is expected to fall to the range of 1880.88

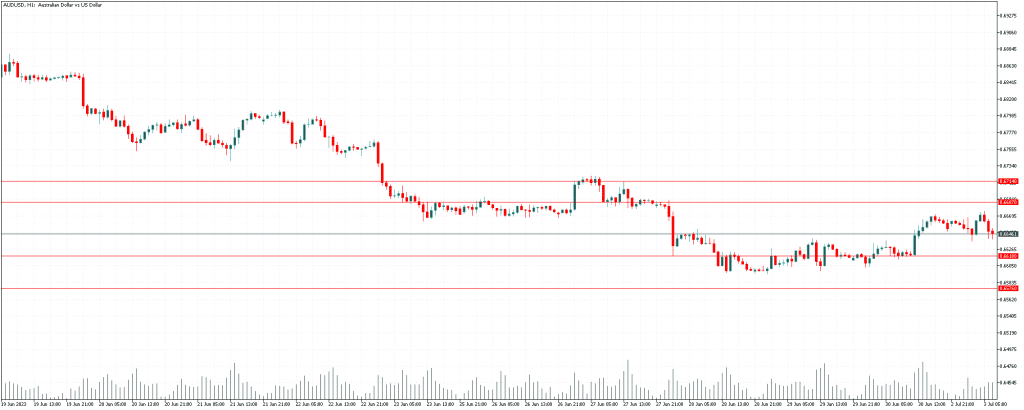

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day. The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day. If the pair continues to trade above the range of 142.839 It is likely to continue climbing to 143.652. On the other hand, if the pair is traded below 142.839, it is expected to continue falling to 140.977.

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day. The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day. If the pair continues to trade above the range of 142.839 It is likely to continue climbing to 143.652. On the other hand, if the pair is traded below 142.839, it is expected to continue falling to 140.977.